An Post Money and Avant Money: Online Lending Innovations for 2025

The increasing digitalization of the financial sector has transformed the way consumers interact with banking and credit services.

Applying for loans online, for example, has become a common practice that offers convenience and accessibility. In this scenario, platforms such as An Post Money and Avant Money have stood out, bringing innovations that meet a wide range of consumers’ financial needs in 2025.

This article explores best practices for applying for loans online, analyzing the services offered by these and other institutions, and providing an overview of the future of online lending.

The Online Lending Revolution

In recent years, the online lending market has grown exponentially. Fintechs such as Finance Ireland and Naked Money have diversified their offerings, allowing consumers to choose products that best suit their profile and financial needs.

The digital revolution has not only simplified the credit application process, but also democratized access to financial information and services.

This means that consumers in different income brackets and locations can find solutions that suit their needs.

The concept behind online loans is their convenience: the ability to apply for a loan anytime, anywhere, without the need for queues or traditional bureaucracy.

This change was not limited to just the user experience, but also brought new demands on lenders in terms of security and transparency.

How Does Online Loan Application Work?

Applying for a loan online is a process that can vary from institution to institution, but in general, it involves some common steps. Here are the main ones:

- Choosing an Institution: Research different financial institutions, such as ICS Mortgages and Permanent TSB, and compare their offers.

- Completing the Form: After choosing the institution, the next step is to fill out an online form with personal and financial information.

- Credit Analysis: Most institutions carry out a credit analysis to verify the applicant's ability to pay.

- Approval and Signature: If approved, the customer will receive a formal offer and will be able to finalize the transaction electronically.

These steps have been simplified by technologies such as artificial intelligence and machine learning, which help analyze data quickly and accurately, speeding up the credit approval process. For example, Revolut has been using these technologies to offer a personalized experience to its users.

Advantages and Disadvantages of Online Loans

Advantages

Online loans offer many advantages, making them an attractive option for many consumers:

- Convenient: Users can apply for loans from anywhere, at any time, using just a smartphone or computer.

- Less Bureaucracy: The process is generally faster and less bureaucratic compared to traditional banks.

- Easy Comparison: There are several platforms that allow you to compare offers from different lenders, such as MoCo and Wayflyer.

Disadvantages

However, online loans also have their disadvantages:

- Variable Interest Rates: Interest rates can often be higher than those offered by traditional banks.

- Risk of Fraud: The lack of physical interaction can increase the risk of fraud and scams.

- Limited Options: Depending on your financial situation, there may be limited options available.

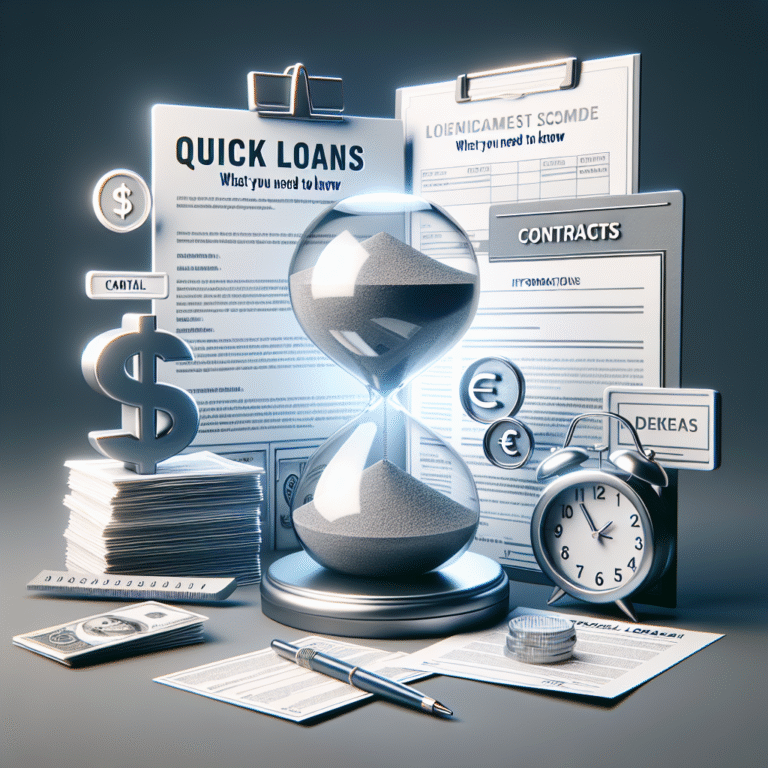

Checklist for Online Loan Application

Before applying for a loan online, it is important to follow a checklist to ensure you are well prepared:

- Check your credit score.

- Research and compare different lenders and their products.

- Read the terms and conditions of the contract, especially the interest rates and charges.

- Prepare all necessary documentation, such as proof of income and identity.

- Make sure the platform is safe and reliable.

Data and Comparative Tables

To help you compare financial institutions, we have provided a table that highlights some important features of different online loan lenders:

| Institution | Interest rate | Payment Term | Maximum Amount |

|---|---|---|---|

| An Post Money | 6.5% – 8.9% | 1 to 7 years | Up to €25,000 |

| Avant Money | 5.9% – 7.5% | 1 to 5 years | Up to €30,000 |

| Bank of Ireland | 7.0% – 9.5% | 1 to 10 years | Up to €50,000 |

| Allied Irish Banks | 7.5% – 10.0% | 1 to 8 years | Up to €40,000 |

Future Trends in Online Lending

As we move into 2025, emerging technologies will continue to shape the future of online lending.

Artificial intelligence is set to play an even more crucial role in order analysis, enabling faster and more accurate decisions.

Additionally, the growing integration of blockchain can offer safer and more transparent lending solutions, reducing the risk of fraud and increasing consumer confidence.

Another relevant trend is the rise of peer-to-peer lending platforms, where individuals can lend directly to other consumers, often at lower rates.

This model can challenge traditional banks by offering viable alternatives for those seeking more affordable loans.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about online loan applications and answers that may clear up your doubts:

- Is it safe to apply for a loan online? Yes, as long as you use trusted platforms and follow recommended security practices.

- What is the difference between personal loans and business loans? Personal loans are for personal use, while business loans are intended to finance business activities.

- How can I improve my credit score? Pay your bills on time, keep your debts under control, and avoid applying for too much credit.

- Can I apply for a loan if I have a bad credit history? Some institutions offer options for people with bad credit, but the rates may be higher.

- What is the maximum amount I can get? The maximum amount varies between institutions and can reach up to €50,000, depending on the creditor.

Conclusion and Call to Action

Applying for a loan online can be a hassle-free experience if you follow the right practices. With innovative options available, such as those offered by Haven Mortgages, BNP Paribas and other institutions, it is essential to compare offers and understand the terms before making a decision.

We invite you to explore the different knowledge bases about online lending, ensuring that you are well informed and prepared to make the best choice for your financial situation.

Explore more about what each institution offers and use the tools available to make the most of your experience. The future of lending is digital, and you’re about to be part of this revolution!